We Help

Business Owners

Thrive With Our

All-In-One Sales & Marketing Platform

[ For BUSINESS OWNERS READY TO Streamline ]

Watch Demo

We're In The Business Of Helping You Grow Yours

4 Features is the first-ever all-in-one platform that will give you the tools, support and resources you need to succeed with your business.

931+

BUSINESSES

16.7K+

CUSTOMERS

5.3M+

LEADS

3.1M+

CONVERSATIONS

This Is Everything

Your Business Needs To Succeed

We bring all the things you need to solve your digital marketing problems in one place.

Danny Hernandez

Shift Realty

"This has been our all-in-one tech stack for everything operations, sales & marketing. Couldn't recommend them more. The platform is powerful, robust and reliable, great job."

Do you want more customers?

With the support of our community, you will know the best strategies the most successful digital marketers are using to make a ton of money online so you don’t have to waste another dollar on.

Do you want to keep your clients longer?

With our all-in-one marketing and sales platform, you will be able to keep your tools in one place (while saving a fortune) and streamline your entire delivery process so you can focus on keeping your clients and customers happy.

Do you want to scale your business?

We will help you grow your business by connecting you with the most successful business owners on the planet who will be able to help you automate your marketing, nurture and fullfillment.

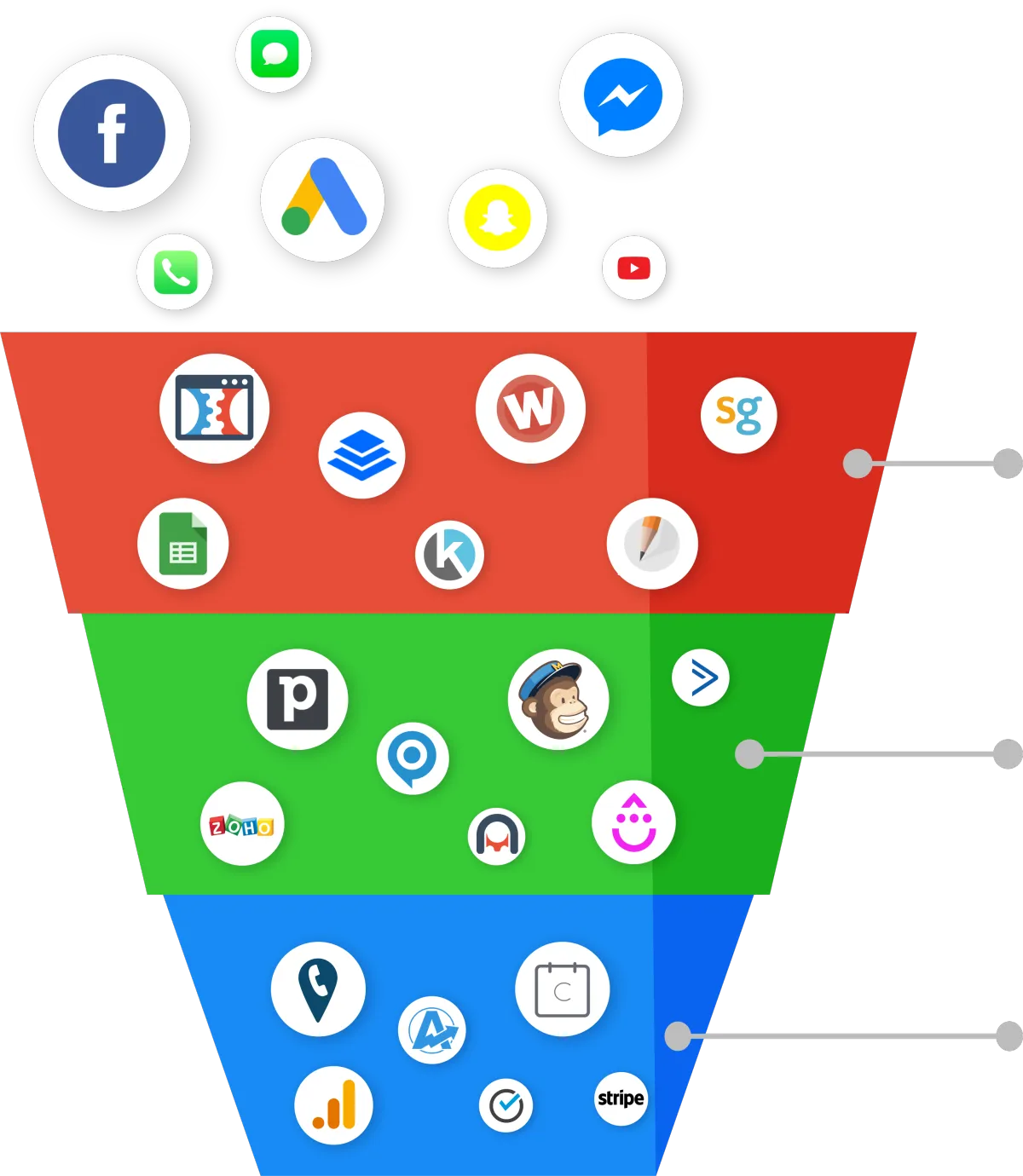

Building The Business Engine

All the tools you need in one platform.

capture

Capture leads using our landing pages, surveys, forms, calendars, inbound phone system & more!

Nurture

Automatically message leads via voicemail, forced calls, SMS, emails, FB Messenger & more!

CLOSE

Capture leads using our landing pages, surveys, forms, calendars, inbound phone system & more!

Capture New Leads

Our thriving community of the most successful and visionary business owners on the planet. Get all the training and resources you need to start or grow your business.

CREATE WEBSITES & LANDING PAGES

Create gorgeous, high-converting landing pages on your domain with 4 Features ’s drag-and-drop builder. Whip up an on-brand showstopper in a matter of hours or get started with a pre-made template in seconds. You can also get fancy by adding custom scripts and integrations.

DRAG & DROP SURVEYS AND FORMS

Build and publish your forms in just minutes. No drudgery, just quick and easy form-building. Select your fields, configure your options and easily embed forms using the built-in tools.

ONLINE APPOINTMENT SCHEDULING

Use the 4 Features calendar to set and manage appointments. With triggers, you can create mini-campaigns for no-show appointments and reminders!

create amazing landing pages

in minutes with the

funnel builder

automate your messages so you can be hands-off

Nurture Leads Into Customers

Join thousands of other owners to learn how they’re being successful and growing their business with 4 Features ...and how you can do the same too.

Easily Customize your follow-up campaigns

With 4 Features , you'll be able to create automated follow up campaigns to any Lead, Prospect or Client all in one central place.

create multi-channel campaigns

When a Lead comes in, you can automatically push a phone call to the lead, drop a voicemail to any contact automatically using a pre-recorded message, and follow up with an automated SMS and Email that can be scheduled at any pre-determined window.

two-way communication on any device

Give the ability of texting to your business. Now you can increase the speed of conversation all in one platform. Available on Desktop and Mobile!

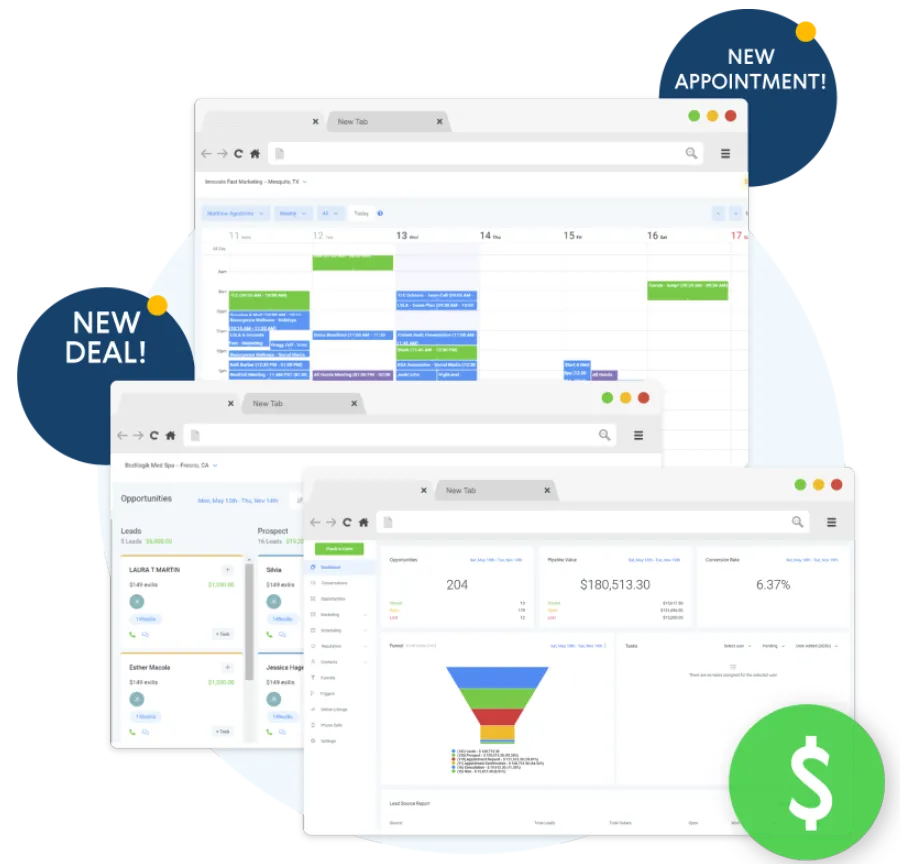

Close More Deals

Join thousands of other business owners to learn how they’re being successful and growing their business with 4 Features ...and how you can do the same too.

manage your workflow and pipeline

The ability to track the leads in a pipeline has become even easier through our advanced Dashboard.

collect customer payments

Turn existing customers into repeat customers by making it easy for them to shop with you again and again.

all the analytics & reports in one place

Track stats such as appointment rates, campaign effectiveness, and even response rates!

ALL THE ANALYTICS

& REPORTS IN ONE PLACE

Award-Winning Support

4 Features provides around-the-clock support and customized support to deliver the best customer experience. Our highly experienced Support Engineers deliver proactive, real-time professional services 24/7 to increase your stability, efficiency, and effectiveness. If you have a question, we have an answer.

makes switching easy

You never need to worry about losing contacts or automations. When you switch to 4 Features , we help you get up and running fast.

free concierge migration

Migrations can be tricky and using a third-party plugin might not always be the best way to go. Sometimes this doesn't bring over everything and could result in data loss if you don't know what you're doing. It's much safer to let our expert migration team handle everything.

24/7 support

When you can't find an answer to your question or problem using the self-training support channels, you can contact the support team.

Join The Movement

Our thriving community of the most successful and visionary business owners on the planet. Get all the training and resources you need to start or grow your business.

community driven development

People do business with people they know, like and trust. Companies don’t make decisions, people do. Your professional network can open doors for you that otherwise could not be opened.

network with other successful BUSINESSES

In business, the biggest deals never happen as you sit behind your computer or in your office. The real needle-movers happen through relationships.

Join The Most Successful Businesses On The Planet

Discover What 4 Features Can Do For You & Your Business

No obligations, no contracts, cancel at any time

Pricing

All Plans Include

✓Unlimited Contacts

✓Unlimited Emails

✓Google My Business

✓ Facebook Messenger

✓Reviews

✓Email Marketing

✓Landing Pages

✓Calendars

✓Surveys

✓Forms

✓Inbound Phone System

Standard

$197

Billed Monthly

$1970/year

✓ 2-Way Messaging & Email Conversation **

✓ GMB Messaging

✓ GMB Call Tracking

✓ Web Chat - Create New Customers Organically

✓ Reputation Management

✓ Facebook Messenger

✓ Missed Call Text Back

✓ Text to Pay

✓ Calendar

✓ Surveys

Professional

$297

Billed Monthly

$2970/year

✓ Everything In Standard +

✓Opportunities

✓ Trigger Links

✓ Triggers

✓ HTML Builder

✓ Word Press Hosting

Premium

$497

Billed Monthly

$4970/year

✓ Everything In Professional +

✓ Memberships

✓ Social Planner

✓ Websites - Design And Integrate With All Your CRM Capabilities

✓ Invoicing

✓ All Reporting

** SMS & Voice usage fees apply

Pricing

All Plans Include

✓Unlimited Contacts

✓Unlimited Emails

✓Google My Business

✓ Facebook Messenger

✓Reviews

✓Email Marketing

✓Landing Pages

✓Calendars

✓Surveys

✓Forms

✓Inbound Phone System

Business Pro Account

$297

Billed Monthly

- everything in business starter

- workflow builder

- analytics & reports

- sales funnels

- websites - Design and integrate with all your crm capabilities

- advanced automation & crm

Business Starter Account

$97

Billed Monthly

- 2-WAY MESSAGING**

- Webchat - Create new customers organically

- Google My Business Messaging

- PIPELINES

- unlimited users

** SMS & Voice usage fees apply

Join The Revolution

"This is a tool that, as a business owner, I am confident will work every time."

BIG LIFE COFFEE

"The campaigns are so simple & easy to create... It's unbelievable."

CROSSFIT EVERSON

"This is like a follow-up nurture sequence on steroids."

SLF INC.

"Best Marketing Automation platform for small and medium enterprises."

CUSTOM CREATIVES

"A very powerful software that helps us save time, automate processes, scale the business."

1st AVE. REAL ESTATE

"I have used different marketing automation platforms and 4 Features is now the best one I can recommend for beginners and SME."

KOMO CONSULTING

Join Our Community Of The Most Outstanding Business Owners On The Planet

Discover What 4 Features Can Do For You & Your Business

No obligations, no contracts, cancel at any time

FEATURES

Insights

Dashboard

Outbound Calling

Appointment Automation

Reputation Management

Unified Messaging

Lead Management

Easy Integration

Mobile App

LEGAL

Security

Privacy

Terms

INTEGRATIONS

Zapier

Webhooks

Open API

affiliates

Affiliate Login

Become an Affiliate

QUICK LINKS

Pricing

Contact

contact us

Let's talk about what 4 Features can do for your business.

cr@4features.com

© 2020 4 Features | All Rights Reserved